what is tax lot meaning

Tax Lot means securities or other property which are both purchased or acquired and sold or otherwise disposed of as a unit. The tax lots are multiple purchases made on different dates at differing prices.

Delinquent Taxes Infographic How To Pay Off Or File Late Taxes Irs Taxes Filing Taxes Tax Help

Tax Lot means the tax lot s on which.

:max_bytes(150000):strip_icc():gifv()/VATV2-28f20651f94242759f222ab1e6293501.png)

. Tax lot accounting is a record-keeping technique that traces the dates of purchase. In the menu located next to the account select Tax Information. Choose the time period and either Realized or Unrealized gain and loss.

Meaning of tax lot. A tax lot is a record of the details of an acquisition of a security. In our example above we sold 20 shares of Company XYZ for 10 per share.

What do tax lots mean. Each acquisition of a security on a different date or for a different price constitutes a new tax. Tax Lot Accounting.

The Best Tax Lot Accounting Definition definition. Information and translations of tax lot in the most comprehensive dictionary definitions resource on the web. Tax lots are documents that relate to any and all transactions that have to do with the investment portfolio.

A method of accounting for a portfolio in which one keeps a record of the purchase price and sale price of each security in the portfolio along with each ones cost basis. What does tax lot mean. What does tax lot mean.

What is Tax Lot Accounting Definition. Tax-lot as a noun means accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment. Tax Lot means a parcel lot or other unit.

By comparing the sale price to the cost basis you and the IRS make an accurate determination on the profits. Tax Lot Accounting Definition signifie Définition de la comptabilité du lot dimpôt. To edit your tax lot.

For married folks filing jointly its 501600. Tax Lot means securities or other property which are both purchased or acquired and sold or otherwise disposed of as a unit. Finally the tax lot includes the sale price of the securities in the lot.

The tax lot will detail the terms of each transaction that involves each security in the. What Is A Tax Lot. A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices.

This page is about the various possible meanings of the acronym abbreviation shorthand or slang term. Go to your Accounts page. A record keeping technique that traces the dates of purchase and sale cost basis and transaction size for each security in your portfolio even if you make.

Tax lot accounting is important because it helps investors minimize their capital gains taxes. Tax lot plural tax lots accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance. Long-term tax lots were purchased more than.

A tax lot is a. Each tax lot therefore will have a different cost basis. The tax rate on long-term capital gains tops out at 20 for single filers who report over 445850 or more in income in 2021.

Each tax lot is labeled with the number of shares its gain or loss per share and its status whether it is a long-term or short-term tax lot. Tax Lot Accounting Definition est un terme anglais couramment utilisé dans les domaines de. What does TAX LOT mean.

This page is about the various possible meanings of the acronym abbreviation shorthand or slang term.

Fixed Overhead Spending Variance Meaning Formula Example And More Finance Class What Is Budget Budgeting

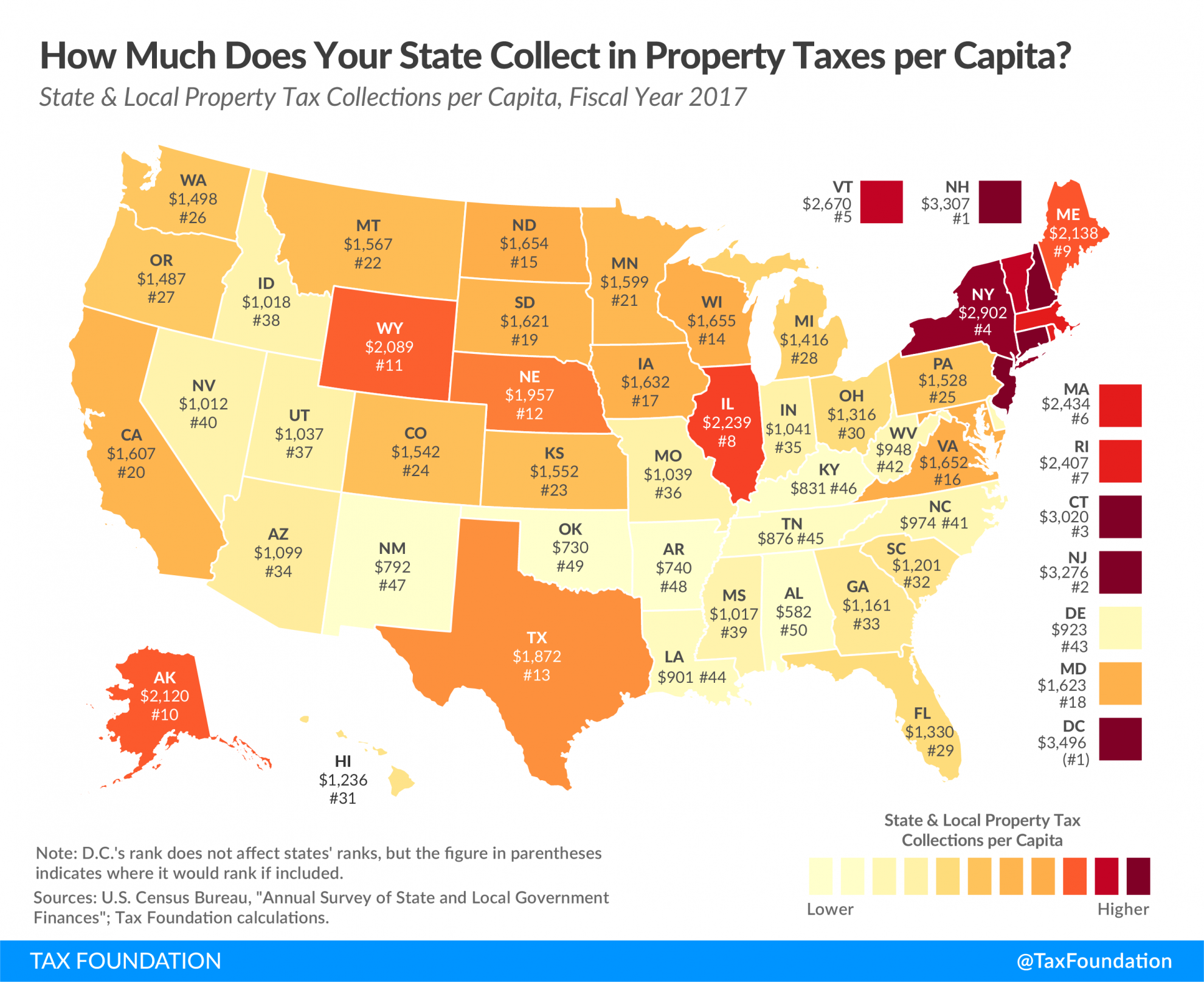

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Example Winning The Olympics Can Be Taxing Olympics Funny Accountant Infographic

Property Tax Definition Property Taxes Explained Taxedu

Federal Income Tax Brackets 2012 To 2017 Novel Investor Income Tax Brackets Tax Brackets Income Tax

:max_bytes(150000):strip_icc():gifv()/VATV2-28f20651f94242759f222ab1e6293501.png)

Value Added Tax Vat Definition Example And Who Pays It

Tax Guide For Canadians Buying Us Real Estate Infographic Tax Guide Us Real Estate Blog Taxes

What Does It Mean When Something Is Tax Deductible Tax Deductions Deduction Financial Tips

/VATV2-28f20651f94242759f222ab1e6293501.png)

Value Added Tax Vat Definition Example And Who Pays It

Tax Shield Meaning Importance Calculation And More Accounting Education Finance Investing Accounting Basics

Your Property Tax Assessment What Does It Mean

Https Www Instagram Com P Crwqqqvnnxn Utm Medium Share Sheet Roth Ira Meant To Be Motto

What Is Professional Tax Online Taxes Tax Legal Services

9 Types Of Irs Letters And Notices And What They Mean Irs Tax Prep Checklist Tax Prep